Best Sales Tax Compliance Software

Keeping up with the ever-changing sales tax rates and regulations is a daunting task for any business — large or small.

Add in the many tax jurisdictions, and it's no wonder many businesses struggle to maintain compliance.

Sales Tax Compliance Software makes life easier. It provides one solution for managing sales tax rates and regulations. The software integrates with your existing software to make things run more smoothly and accurately.

The best sales tax compliance software will have the following features:

- A central repository for sales tax rates and regulations

- The ability to create and manage multiple tax profiles

- Integration with existing ERP, eCommerce platform, CRM

- Accuracy and compliance assurance

- Automated tax filings

In this article, we look at the best sales tax compliance software available in 2023.

What Are The Best Sales Tax Compliance Software?

The following are the best sales tax compliance software on the market right now:

Avalara

Avalara Tax Compliance Suite is a sales tax software that maintains tax rules and rates. It fully automates tax determination to help businesses manage compliance and mitigate audit risk.

Avalara offers over 600 pre-built integrations to current business applications, which speeds up the implementation process without disrupting business processes. For example, you can easily connect it to Shopify, BigCommerce, and WooCommerce.

Key features

- Jurisdiction assignment: Avalara checks the full address to make sure it is correct. It uses mapping technology to find out which region the address is in for tax. Avalara knows which taxes need to be calculated for sales, use, and VAT tax reporting in different regions.

- Global coverage: Avalara keeps track of the different tax rules and rates in the U.S. Avalara also supports European VAT, India GST, full compliance in Brazil, and tax calculations for countries around the world.

- Cloud deployment: Avalara's software is cloud-based, so you can access it from anywhere.

- Comprehensive reporting: Avalara's reports summarize the history of transactions for preparing returns, reconciling, tax analysis, and audit readiness.

Pricing

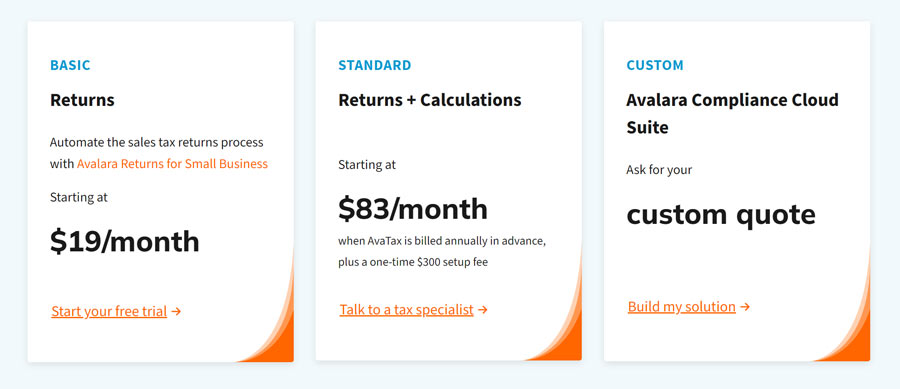

Avalara offers three subscription plans:

- Basic - $19/month

- Standard - $83/month

- Custom - custom pricing

TaxJar

Best for small businesses

TaxJar is a sales tax automation solution that integrates with custom eCommerce platforms and accounting software. It offers real-time tax calculation, streamlined compliance, and comprehensive reporting.

TaxJar has excellent support for small businesses. For example, if you need to have access to all the data related to sales tax and you want a team of experts to help you. TaxJar offers white-gloved support and can automate your monthly, quarterly, or annual filings in multiple states.

TaxJar also provides a REST API for developers who want to build their integrations.

TaxJar is a sales tax software created for digital businesses. This software helps with real-time calculations of associated tax liabilities at the point of sale and nexus tracking. TaxJar also provides help with reporting and filing sales taxes.

TaxJar helps sellers by connecting with their ERP system and many popular online marketplaces. In 2021 Stripe acquired TaxJar. Since then, they integrated TaxJar into their products to help their customers.

Key features

- Omnichannel sales: Let's you calculate sales across different platforms like Amazon, eBay, and Etsy.

- Integrates with Shopify, Stripe, QuickBooks, and other software.

- Automatically submits tax returns and remittances to each jurisdiction

- TaxJar's sales tax API is very fast (under 20ms) and it has 99.99% uptime.

Pricing

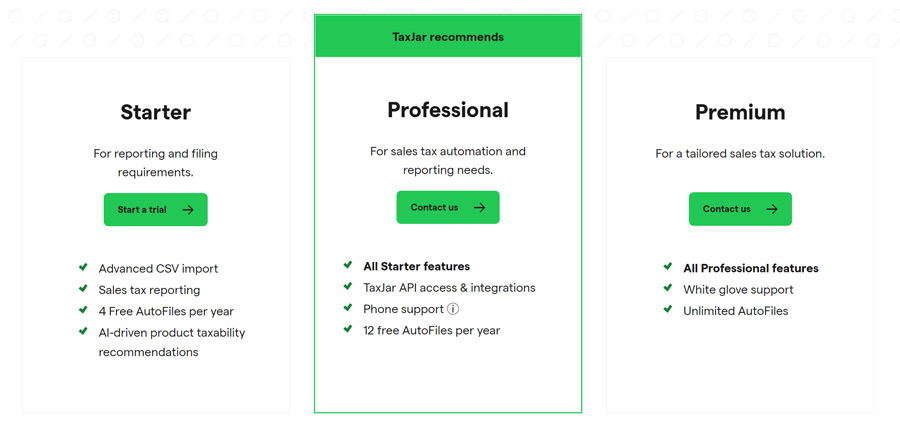

TaxJar's pricing includes 3 plans:

- Starter - $19.00/month

- Professional - $99.00/month

- Premium - Custom

Vertex

Best tax software for enterprises

Vertex is enterprise tax software that offers end-to-end tax management for global businesses. It integrates with your current business applications and provides comprehensive visibility into the tax process.

60% of Fortune 500 use Vertex for tax compliance. Vertex offers comprehensive support for businesses with complex tax needs. For example, if you have multiple subsidiaries in different countries, Vertex can help you manage the tax compliance for all of them.

The solution includes innovative tools, up-to-date tax content, and an easy-to-use interface. The solution also increases the accuracy of calculations and compliance data. You can access the interface anytime and anywhere, making it easy for businesses to scale.

Key features:

- Global tax compliance: Helps businesses with multiple subsidiaries in different countries manage their tax compliance.

- Innovative tools: Up-to-date tax content and an easy-to-use interface that increases accuracy and compliance data.

- Integrations to connect with Vertex from leading ERP, procurement, and e-commerce platforms.

- Exemption certificate management - You can either upload exemption certificates in bulk or one at a time. You can set the effective and expiration dates for each certificate. You can store the certificates in the Vertex Cloud Indirect Tax system. And you can manage customer exemptions using this software.

Sovos

Sovos is a comprehensive tax compliance solution that facilitates audits and supports constantly changing tax laws.

Sovos offers a suite of sales tax compliance solutions:

- CertManager - Automate getting exemption certificates from customers.

- Sales & Use Tax Filing - File and pay sales taxes to over 12,000 jurisdictions in the U.S.

- Filing Managed Services - Make sales tax filings quick and easy with help from tax professionals

- Use Tax Manager - Compare the taxes you have paid to the taxes you should have paid.

- Global Tax Determination - Simplify tax determination in any jurisdiction.

- Taxify - Solve sales tax filings complications for small to medium-sized businesses.

Key features

- Integrates with many popular enterprise and eCommerce systems, including the most widely used ERP and POS systems.

- Manages compliance for the most complex states, product types, and scenarios. This includes variables such as caps, thresholds, coupons and refunds, bracket taxing, rental taxes, tax holidays, urban enterprise zones, and more.

- Manage to get tax exemption certificates. It collects and archives the certificates, validates them, and provides real-time reporting and audit defense.

- Automates sales tax filings for hundreds of monthly returns and sub-schedules in every jurisdiction.

TaxCloud

TaxCloud is a cloud based sales tax management solution.

TaxCloud provides a variety of solutions, from finding tax rates to full service sales tax registrations, collections, filings, and remittance.

TaxCloud works with state and local governments to help businesses pay their taxes. This allows TaxCloud to offer the best tax data, the lowest prices, and the best value for businesses' sales and purchase transactions in the USA. The state-paid option is available in 25 member states.

Key features

- Integrations with popular ecommerce platforms and accounting software.

- Offers a free plan for small businesses and a paid plan for larger businesses.

- Address validation to help ensure sales taxes are calculated correctly.

- Automated Compliance-as-a-Service to manage sales tax data filings and payments.

- NexusTracker to help businesses keep track of their sales tax Nexus.

Pricing

TaxCloud pricing is based on the number of transactions:

- $20 per thousand between 1 and 1k requests

- $10 per thousand between 1k to 15k requests

- $7.5 per thousand between 15k to 200k requests

- $5 per thousand for more than 200k calls

FastSpring

Best for digital products (SaaS, e-books, online courses)

FastSpring is a global ecommerce platform that provides software companies with a complete solution for selling their products online.

FastSpring is more than taxes.

The software manages customers for your SaaS or software-based business. It helps you with everything from purchase to subscription management to taxes.

The sales and use tax features in FastSpring makes you tax compliant in every US state and many other countries around the world.

Key features:

- Handles payment and collects the sales tax for digital goods on your website.

- Remits sales tax and VAT on every purchase made through the platform. They file all necessary tax returns for you - over 1,000 returns around the world every year.

- Keeps track of your subscriptions, monitor for fraud, increase your approval rates, keep you compliant with regulations, and respond to any audits related to sales taxes or VAT.

Thomson Reuters ONESOURCE

Best corporate tax solution

Thomson Reuters provides you with a way to automate your tax and accounting processes. The software will help save you money and make the process easier.

ONESOURCE Tax Information Reporting software and services offer a complete solution for U.S. federal and state taxes, as well as Canadian taxes. This includes TIN Compliance, withholding management, and industry training.

ONESOURCE Trust Tax is a program that helps wealth managers automate the process of tax compliance for fiduciary taxes. This includes data management and the creation of 1099 and 1042-S reports.

Thomson Reuters also offers local training and support so you can learn how to use their product.

Key features

Built-in tax returns and associated disclosures

- Tax working papers for review and understanding of tax computations.

- Multi-language support.

- Automatic rolling forward of information from prior years

- Transparent logic of tax determination and calculations.

- Complete audit trail, automatic error checking, visible formulae, and transparent cross-referencing between all schedules. This means that you can be sure that your data is always accurate and reliable.

- Statutory Reporting provides standardization, accuracy, and efficiency of your sales tax reporting to help you meet your legal obligations.

What is Sales Tax Compliance Software?

Sales Tax Compliance software is a solution that helps businesses file and remit sales taxes correctly. This software can automate the process of filing sales taxes electronically, as well as integrate with popular eCommerce platforms. Additionally, it can help manage multiple tax jurisdictions for businesses.

It is difficult to get sales tax right.

The rules keep changing, and it's hard to follow all the different regulations. If businesses do not automate their sales tax processes, they can make mistakes and not comply with the law. They might also be less efficient than competitors who use sales tax compliance software.

According to the Future of E-Commerce Compliance report, 45% of financial professionals feel overwhelmed with sales tax compliance because they weren’t made aware of rate changes. Also, 92% of sales tax compliance software users believe it’s the job of your compliance software to stay up to date with tax obligations for each state and jurisdiction.

Sales Tax Compliance Software FAQ

What is automated tax compliance?

Automated tax compliance is the ability to file and remit sales taxes without any manual intervention. This means that businesses do not have to worry about changing tax rates, new rules, or filing deadlines. The software will automatically file the correct return and make the payment on time.

What is a sales tax engine?

A tax engine is a fully integrated piece of software that's built to keep you up to speed on sales and use tax rules, as well as international tax standards such as VAT and GST. It ensures that your company's transactions are correctly taxed and charged. The sales tax engine connects with other software, like ERP, CRM, and e-commerce systems.

Conclusion

We reviewed the best sales tax compliance software on the market.

Sales tax compliance services as a software solution is not a new concept, but the market has seen a surge in demand for these services in recent years. This is due to the growing complexity of sales tax laws and the need for businesses to stay compliant.

These solutions simplify sales tax compliance for businesses of all sizes, in any industry. No matter how complex your sales tax needs are, there is a solution that can help.

To conclude, best sales tax compliance software is:

- Avalara is a good choice for businesses that need a comprehensive sales tax solution for handling taxes in multiple jurisdictions. It can also integrate with popular eCommerce platforms like Shopify, BigCommerce, and WooCommerce.

- If you are looking for a more affordable solution, TaxJar may be the right fit for your business. This software is ideal for small businesses

- Sovos offers comprehensive filing with support for thousands of jurisdictions.

- Vertex is a sales tax compliance solution that offers automated sales tax filing and remitting, as well as support for businesses in multiple jurisdictions.

- Thomson Reuters ONESOURCE is another good option if you need a comprehensive solution for sales tax compliance. The key feature of this software is statutory reporting, which provides standardization, accuracy, and efficiency of your reporting.

- FastSpring is a good choice if you are looking for a software solution that is all-in-one and easy to use. This software can automate the entire sales tax compliance process for your business.

Ultimately, the best sales tax compliance software for your business depends on your specific needs. Consider these factors when choosing a solution: ease of use, price, features, customer support, and integrations.

Josip Miskovic is a software developer at Americaneagle.com. Josip has 10+ years in experience in developing web applications, mobile apps, and games.

Read more posts →Last modified on:

I've used these principles to increase my earnings by 63% in two years. So can you.

Dive into my 7 actionable steps to elevate your career.